INFO THAT HITS US WHERE WE LIVE...

Confirming the insight of the Hibernian bard, the housing market

happily kept growing in December. Existing Homes Sales went up 1.0%, to a

4.87 million annual rate.

For all of 2013, 5.09 million existing homes were sold, up 8.9% from 2012, and the best annual sales level since 2006.

Yes, existing home sales have slowed over the past few months, but this

situation is not expected to last. Analysts observe that a lack of

inventory has been leading some potential existing home buyers to

purchase new homes instead. Existing home inventories, in fact, dropped

9.3% in December, close to all-time lows.

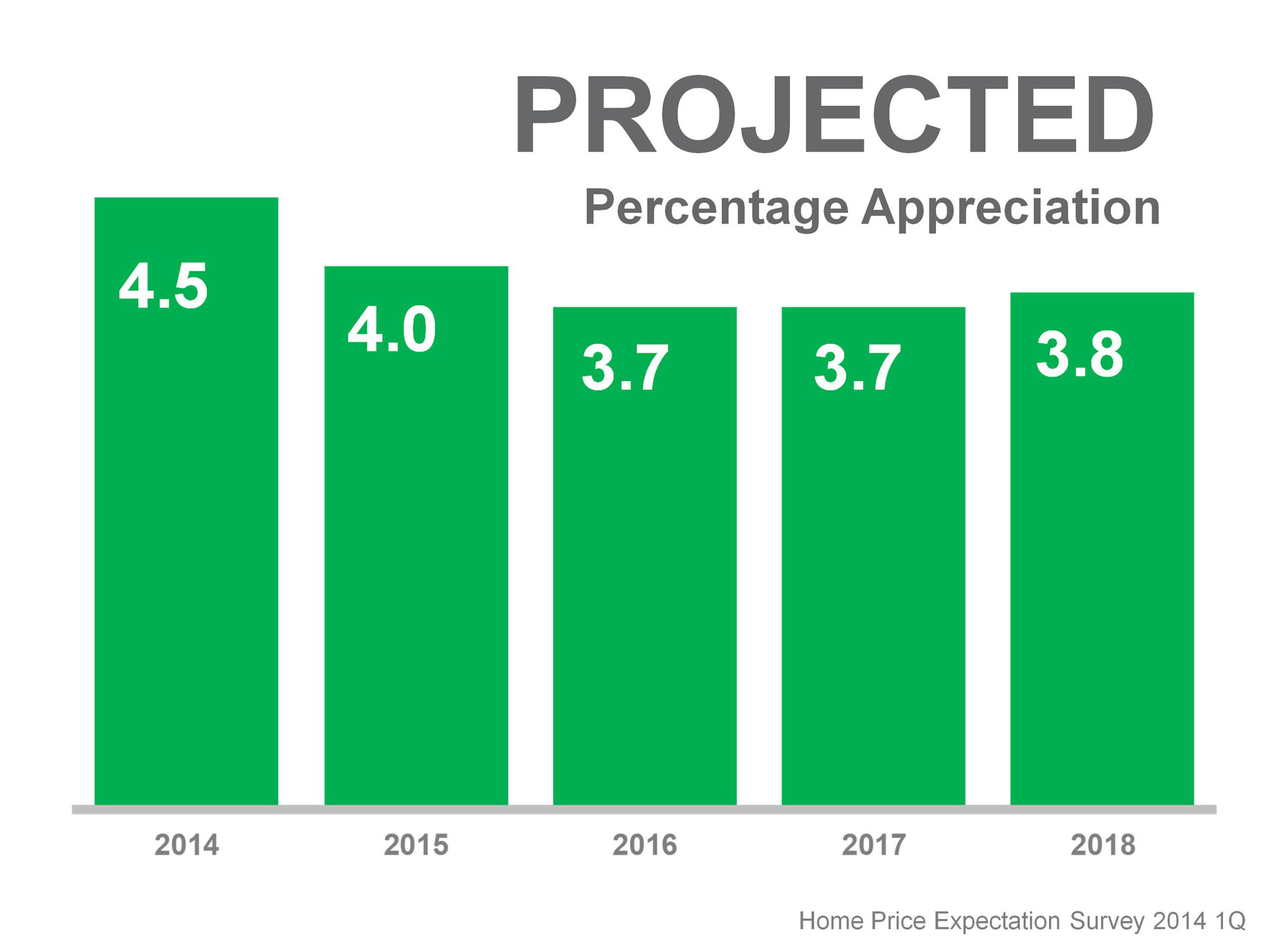

Observers see more homes coming onto the market this year, as prices move higher. Right now, existing home median prices are up 9.9% versus a year ago, to $198,000. Average prices are up 8.6% over last year.

The FHFA index of prices for homes financed with conforming mortgages

went up 0.1% in November. This was the smallest hike in 16 months, but

the index is up 7.6% over a year ago. Economists expect home prices to

keep edging up, though not as much as last year. They feel that as home

builders ramp up, the additional supply will slow the rate of price

gains compared to last year.

BUSINESS TIP OF THE WEEK... Don't get caught up responding to crises. Instead, have a plan for proactively tackling projects each day. Commit time for every task, then set aside an extra block for unexpected events.

>> Review of Last Week

DOWN DOWN DOWN DOWN... Those

four words perfectly describe the four days of the Dow's performance

during a trading week shortened by Monday's Martin Luther King Jr. Day

holiday.

Both the Dow and the S&P 500 suffered their worst weekly losses in more than a year.

The tech-y Nasdaq fared better but still lost ground for the week. Some

observers explained all the downward motion as merely the start of a

stock market correction, following the record setting performances we

saw last year. Others felt it reflected continuing economic concerns.

Those worries began with China, thanks to our interconnected global economy. The HSBC Flash PMI reading indicated Chinese manufacturing contracted slightly in January, plus there were concerns over the health of the Chinese shadow banking system. Over here, Existing Home Sales and Leading Economic Indicators were each up slightly, but less than expected. Although

weekly jobless claims were up by 1,000, the four-week moving average

dropped again from the previous reading, which is definitely a positive.

The week ended with the Dow down 3.5%, to 15879; the S&P 500 down 2.6%, to 1790; and the Nasdaq down 1.7%, to 4128.

Tumbling

stocks sent bond prices skyward, with Treasuries in particular

registering solid gains. The FNMA 3.5% bond we watch ended the week up

.86, to $101.06.

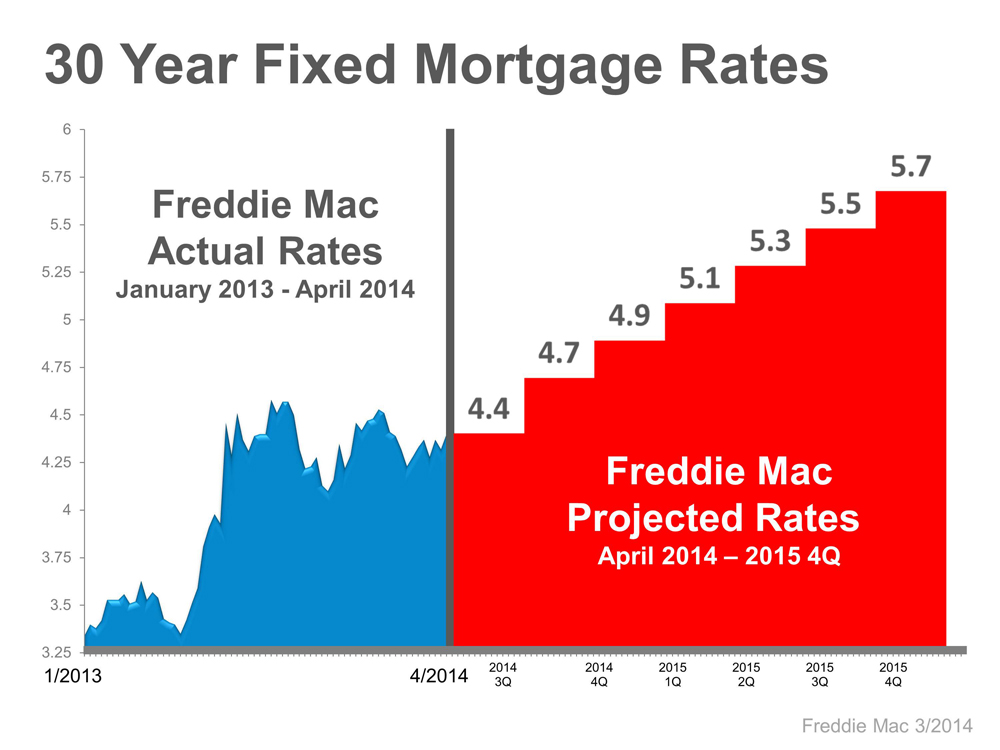

In Freddie Mac's Primary Mortgage Market Survey for the week ending January 23, national average fixed mortgage rates drifted a tick lower for the second week in a row. "Reports that inflation remains subdued" were given as the reason for the decline. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up to the minute information.

DID YOU KNOW?...

The latest Fed Beige Book reported that most Federal Reserve districts

witnessed increased residential sales activity, construction, and home

prices from late November to the end of 2013.

>> This Week’s Forecast

NEW AND PENDING HOME SALES, GDP, MIDWEST MANUFACTURING SLIP, THE FED MEETS... December

New Home Sales and

Pending Home Sales should be off a bit, as well as overall economic growth in Q4, according to the

GDP – Advanced reading. The important

Chicago PMI is forecast to show a slower rate of expansion for manufacturing in the Midwest. Wednesday's

FOMC Meeting will tell us how the Fed will taper their bond buying program, although the Funds Rate isn't expected to budge.

Other notable reports include Personal Spending, which is predicted to slow a little in December. But Core PCE Prices should show inflation is still under control.

>> The Week’s Economic Indicator Calendar

Weaker than expected economic data tends to send bond prices up and

interest rates down, while positive data points to lower bond prices and

rising loan rates.

Economic Calendar for the Week of Jan 27 – Jan 31

| Date | Time (ET) | Release | For | Consensus | Prior | Impact |

M

Jan 27 | 10:00 | New Home Sales | Dec | 457K | 464K | Moderate |

Tu

Jan 28 | 08:30 | Durable Goods Orders | Dec | 2.1% | 3.4% | Moderate |

Tu

Jan 28 | 10:00 | Consumer Confidence | Jan | 77.5 | 78.1 | Moderate |

W

Jan 29 | 10:30 | Crude Inventories | 1/25 | NA | 0.990M | Moderate |

W

Jan 29 | 14:00 | FOMC Rate Decision | Jan | 0%–0.25% | 0%–0.25% | HIGH |

Th

Jan 30 | 08:30 | Initial Unemployment Claims | 1/25 | 325K | 326K | Moderate |

Th

Jan 30 | 08:30 | Continuing Unemployment Claims | 1/18 | 3.000M | 3.056M | Moderate |

Th

Jan 30 | 08:30 | GDP – Advanced | Q4 | 3.0% | 4.1% | Moderate |

Th

Jan 30 | 10:00 | Pending Home Sales | Dec | –0.2% | 0.2% | Moderate |

F

Jan 31 | 08:30 | Personal Income | Dec | 0.2% | 0.2% | Moderate |

F

Jan 31 | 08:30 | Personal Spending | Dec | 0.2% | 0.5% | HIGH |

F

Jan 31 | 08:30 | PCE Prices - Core | Dec | 0.1% | 0.1% | HIGH |

F

Jan 31 | 08:30 | Employment Cost Index | Q4 | 0.4% | 0.4% | HIGH |

F

Jan 31 | 09:45 | Chicago PMI | Jan | 58.0 | 60.8 | HIGH |

F

Jan 31 | 09:55 | U. of Michigan Consumer Sentiment – Final | Jan | 80.4 | 80.4 | Moderate |

>> Federal Reserve Watch

Forecasting Federal Reserve policy changes in coming months...

The focus of this week's FOMC meeting will be on what the Fed will do

about tapering its bond buying program. Economists do not expect the

super low Funds Rate to budge.

Note: In the lower chart, a 1% probability of change is a 99% certainty the rate will stay the same.

Current Fed Funds Rate: 0%–0.25%

| After FOMC meeting on: | Consensus |

| Jan 29 | 0%–0.25% |

| Mar 19 | 0%–0.25% |

| Apr 30 | 0%–0.25% |

Probability of change from current policy:

| After FOMC meeting on: | Consensus |

| Jan 29 | <1 span=""> |

| Mar 19 | <1 span=""> |

| Apr 30 | <1 span=""> |

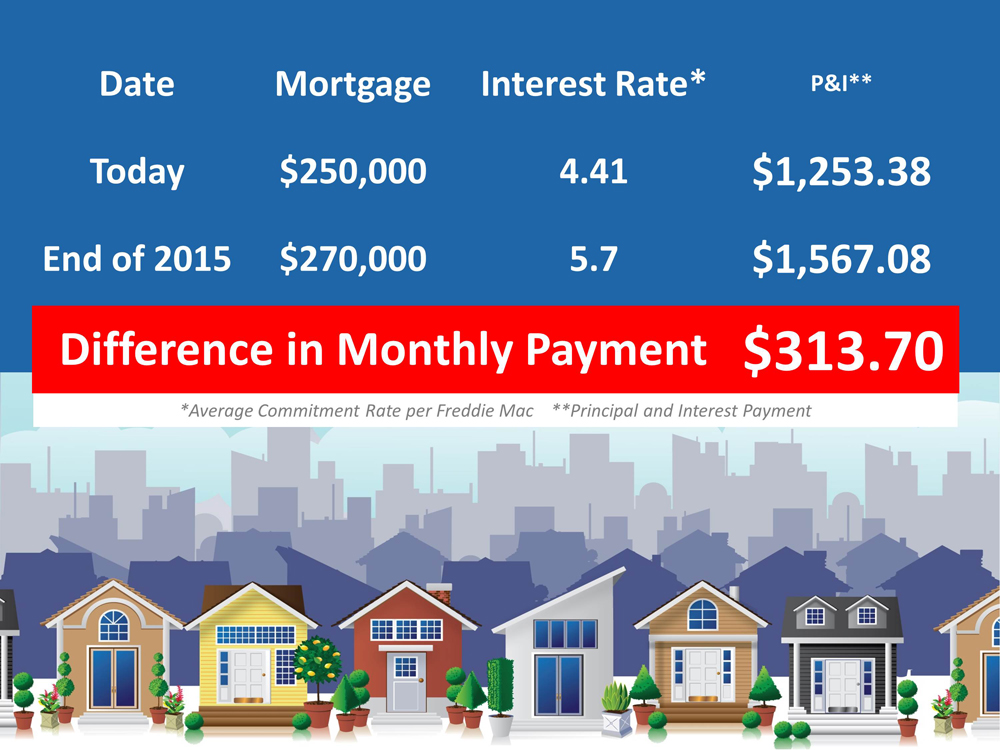

We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family is ready, willingand able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy.

We have never hid our belief in homeownership. That does not mean we think EVERYONE should run out and buy a house. However, if a person or family is ready, willingand able to purchase a home, we believe that owning is much better than renting. And we believe that now is a great time to buy.

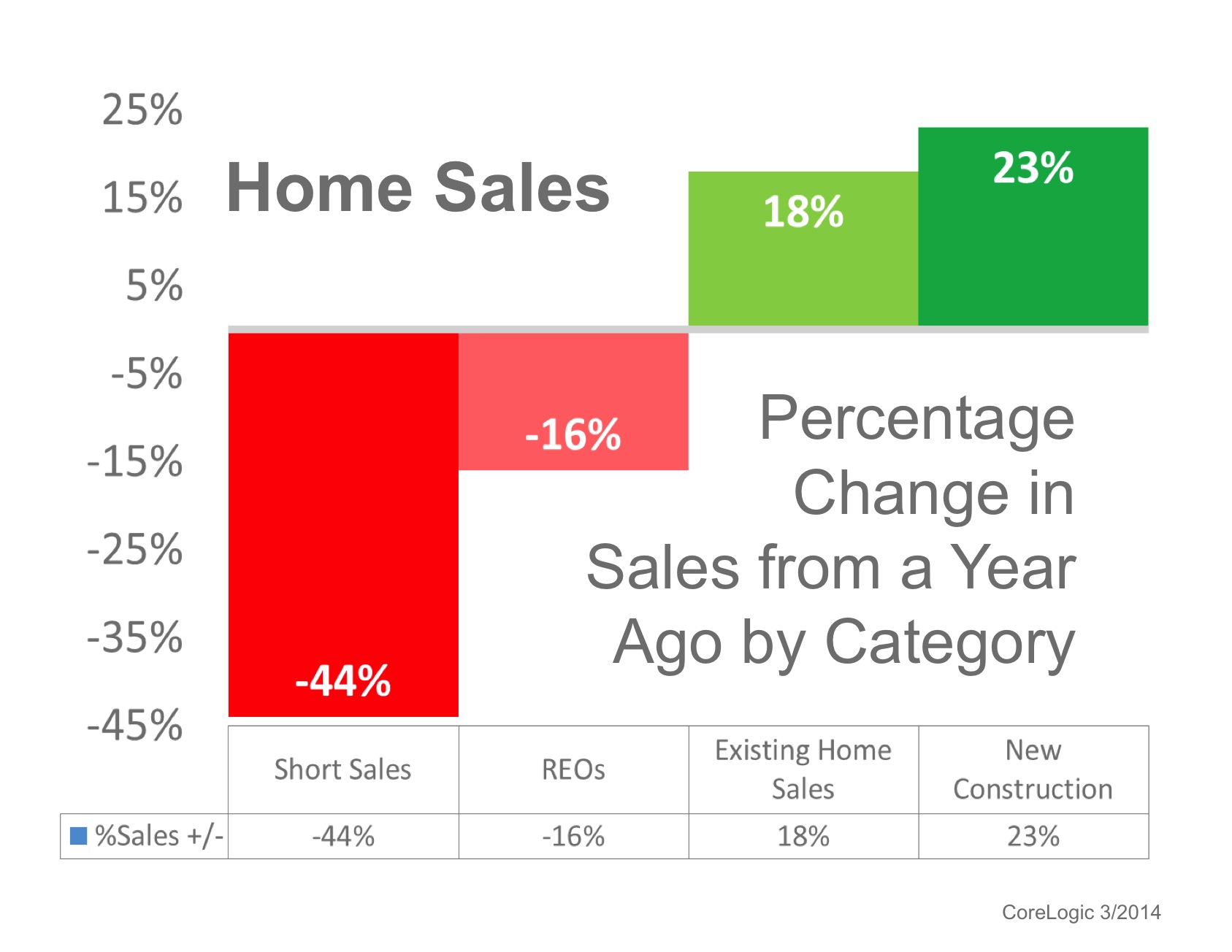

Many housing pundits are calling for home sales to do slightly better in 2014 than they did in 2013. To the contrary, we

Many housing pundits are calling for home sales to do slightly better in 2014 than they did in 2013. To the contrary, we

Despite the quiet calendar, there was news to note in the housing

arena. The National Association of Realtors reported that Existing Home

Sales rose by 1 percent from November to December to an annual rate of

4.87 million units. This was the first monthly gain in three months. For

all of 2013, there were 5.09 million existing home sales, which was 9.1

percent higher than 2012. The housing market continues to rebound,

though at a modest pace.

Despite the quiet calendar, there was news to note in the housing

arena. The National Association of Realtors reported that Existing Home

Sales rose by 1 percent from November to December to an annual rate of

4.87 million units. This was the first monthly gain in three months. For

all of 2013, there were 5.09 million existing home sales, which was 9.1

percent higher than 2012. The housing market continues to rebound,

though at a modest pace.

Reprinted with permission. All Contents ©2014 The Kiplinger Washington Editors.

Reprinted with permission. All Contents ©2014 The Kiplinger Washington Editors.