It is crucially important that, as experts in the real estate field, we can articulate what is actually taking place in the housing market…especially when news headlines are causing confusion. That is definitely the case right now when it comes to existing home sales numbers.

Overall, sales volumes are down. We realize that. However, a closer look at the numbers show that certain categories and price ranges are down while others are up.

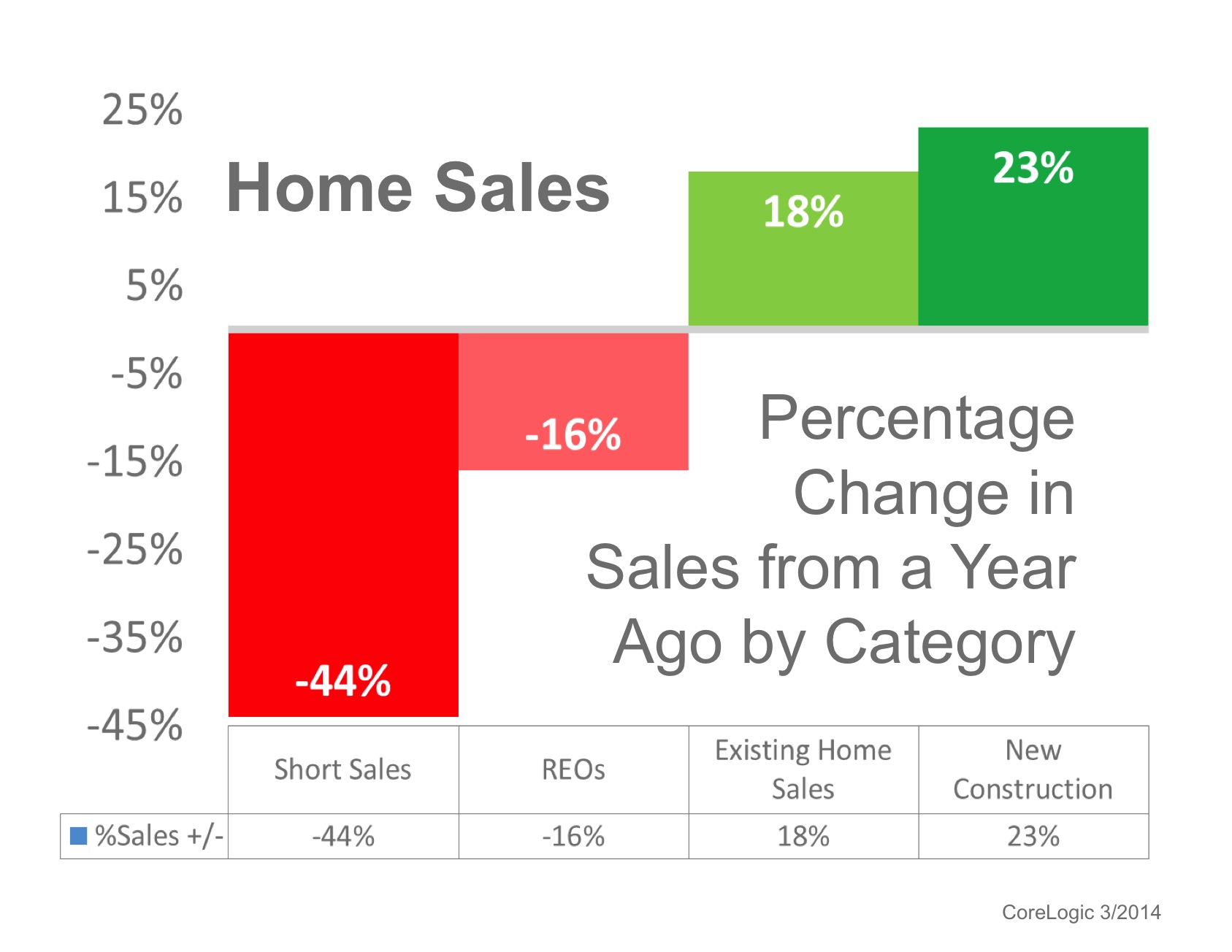

Below is CoreLogic’s breakdown of recent sales compared to last year by category. As we can see, distressed property sales are down while non-distressed property sales are up.

Now let’s look at NAR’s breakdown of recent sales by price point. As we can see, lower priced homes (distressed properties?) are down while every category over $250K increased.

Let’s make sure we promote what is actually happening with home sales to consumers in our markets.